Lifestyle Is a Choice

The Dominican Republic has been the top vacation destination in the Caribbean since 2005, by a considerable margin, according to the World Bank.

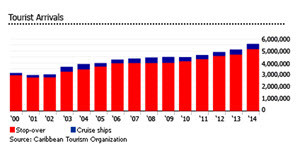

- Through the first half of 2015, which is the latest stats I have on hand, tourism arrivals are up over 6.8% from the same period a year earlier.

- In 2014, the country received around 5.14 million stay-over tourists, up by 9.6% from a year earlier while the number of cruise ship passengers also increased 2.7% to 435,494 people over the same period.

- In 2013 the tourist arrival growth rate was 2.79% over 2012. In 2012 the growth rate from 2011 was 6%. 2011 was up 4.4% over 2o10. Even during the rather bleak financial crisis of 2008 – 2009 the tourism arrivals remained relatively constant.

Dominican Republic Tourist Arrival Trend

So as you can see, the pace of tourism in the Dominican Republic plods along at a fairly steady pace and along with that flow of incoming traffic, many elements of the economy have benefited. In today’s post we will talk a bit about how this steady growth of tourism has also impacted real estate up on the North Coast of the island.

It turns out that the Dominican Republic is the top Caribbean choice for foreign property buyers, especially to full-time expats, retirees, and second-home investors. As you would expect, a large percentage of the sales of both apartments and homes has been in some of the more touristy areas such as Punta Cana, Bavaro, Boca Chica and Santo Domingo in the South and South East and Las Terrenas, Sosua and Cabarete on the North Coast. As you would expect, property prices in these areas have jumped right along with the influx of more tourists. For example, in the nearby tourist town of Cabarete, a typical small oceanfront condo starts around $120,000 while a managed quality condo would start closer to $250,000. An oceanfront home in the Cabarete area would typically run between $160 and $250 per square foot, or more.

Overall, residential property prices in the Dominican Republic have been rising an average of 10% every year since the 2008 – 2009 economic crisis……

Along with higher real estate prices, the cost of construction has also been increasing from 3% to 5% per year. Even with that level of consistent price escalation, real estate prices for coastal properties in the Dominican Republic are still a bargain compared to property prices on other islands in the Caribbean. The Dominican Republic is widely acknowledged to be one of the least expensive housing markets in the Caribbean.

On the brighter side (at least the more affordable side), in our area of the North Coast, near the village of Cabrera, prices are less inflated and your dollar tends to go further with both existing homes and with new construction. New construction costs for a fairly average home start around $60 per square foot plus the cost of land. With a careful eye, you can still find affordable, quality existing hillside homes in gated communities with great ocean views for as little as $75 per square foot.

One interesting thing to note about much of the real estate in the Dominican Republic. Historically, many of the real estate transactions were conducted in cash, so the Dominican Republic did not suffer through much of the mortgage-based debt crisis that many of the hot markets of the United States faced, resulting in far fewer loan defaults and less hyperinflation on the way up. This has resulted in a more stable real estate market and is a perfect example of the diversification we are always talking about. It is generally a good idea to spread your real estate investments across multiple markets that tend to follow different cycles and pose different market risks.

While diversification of investments and relative stability of real estate prices are a couple great reasons to consider the Dominican Republic, there are other reasons that place the Dominican Republic high on the list of places Americans, Canadians and Europeans should consider a second home or retirement. Just a few of those include:

Foreign property investments are greatly encouraged by the Dominican Republic government. Incentives, according to the country’s tourism office include:

- Tax-free receipt of pension income from foreign sources, including the possibility of moving belongings to the country, is guaranteed by Law 171-07 on Special Incentives for Pensioners and Persons of Independent Means.

- Foreign buyers receive a 50% exemption from property tax

- Exemption of taxes on the payment of dividends and interest, generated within the country or overseas

- Foreign buyers receive a 50% exemption on taxes on mortgages, when the creditors are financial institutions that are regulated by Dominican financial monetary law

- Exemption on payment of taxes for household and personal items

- Exemption from taxes on property transfers

- Partial exemption on vehicle taxes

There are a couple other things happening on the North Coast right now that will probably drive above average escalation of property prices in the Cabrera area over the coming years.

Aman Playa Grande Beach Club

First, the Aman Beach Club at Playa Grande just opened the most exclusive high end golf resort in the Caribbean only about 7 miles to the west of Cabrera. With cottages renting for around $1,200 per night, this new high end resort is attracting financially independent investors from around the world. Some will choose to invest in real estate in the area at the current low prices. These visitors will certainly nudge the prices up on higher end and more unique properties, but will probably also put upward pressure on most quality properties in the area.

Puerto Plata Cruise Terminal

The other event that is introducing more tourists to the area and the North Coast is the new cruise port in Puerto Plata. While the Cabrera area will not see the influx of day tourists from the cruises, it probably will benefit from the increased awareness of the whole North Coast area and will catch some spillover from more independent travelers and investors.

While an investment in real estate on the North Coast may not be your cup of tea right now, I do believe you can benefit from watching what will happen to real estate in the region over the next few years. There will be a time when even the most ardent procrastinators will be better prepared to handle an inevitable financial collapse by studying how diversification can level out risks.

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_4.gif)

![[Most Recent Charts from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)

Comments on this entry are closed.